On January 8, 2019, Councilmember David Grosso, along with Councilmembers Robert White, Brianne Nadeau, and Anita Bonds, introduced the Marijuana Legalization and Regulation Act of 2019.

Different sections of the law were referred to the committee on Judiciary and Public Safety, Committee on Business and Economic Development, Committee on Finance and Revenue, and Committee of the Whole with comments from the Committee on Transportation and the Environment. No hearings have been scheduled yet.

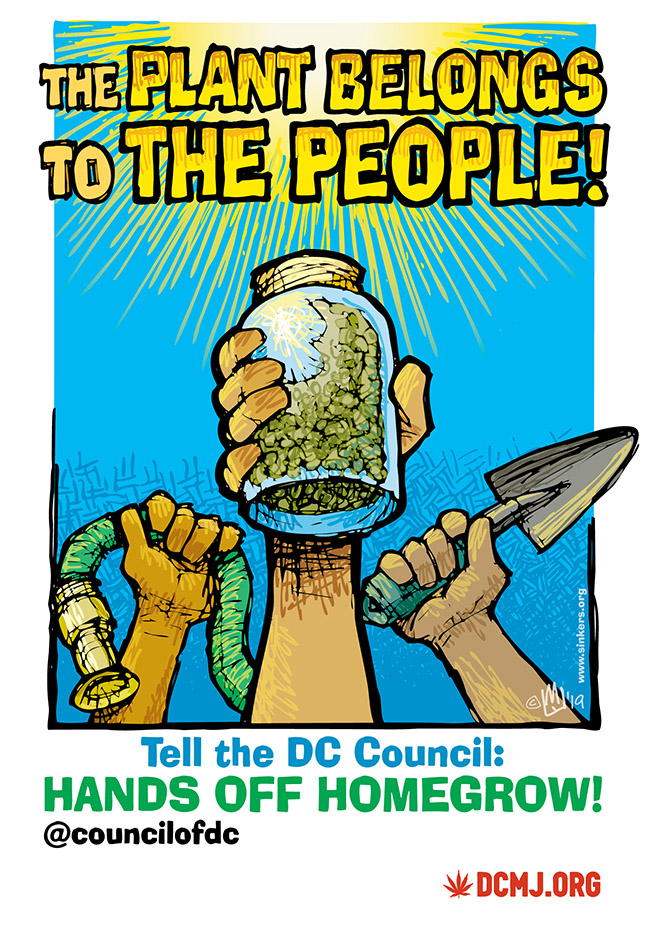

With the Mayor’s Safe Cannabis Act of 2019, there are now two different cannabis legalization bills before the DC Council. We believe that the best law will be a hybrid of both laws and ample witness testimony provided by DC’s cannabis community.

In order to obtain the DC cannabis community’s concerns about this legislation, we have created a thorough community feedback form here on our website. The entire legislation broken into chapters where you can provide feedback for each section. At an upcoming DCMJ Planning Meeting, before the public hearing, we will go over the community feedback and draft our testimony based on the feedback you provide.

DC CANNABIS COMMUNITY FEEDBACK INSTRUCTIONS:

- We suggest reading the entire legislation first before making any comments. You don’t have to be a lawyer to understand the law! By reading the legislation in it’s entirety you can get a better picture of the legislation.

- Find parts of the legislation you like, dislike, would like to have changed or added to

- Find the corresponding Chapter and Section on this page (Like Chapter 25, Section 03 = 2503) and select the proper dropdown box. Some Sections have Subsections (a, b, c, d, etc.), while others don’t. To ensure your feedback is the most direct, include the Subsection when available

- Enter your feedback into the Google Form. Be as descriptive as possible. Explain why you think the section is good, bad, needs to be removed, or changed

- Attend an upcoming DCMJ Planning Meeting to discuss your feedback and hear other’s feedback. By including your email address, we will add you to the DCMJ email list so you’ll know when we are discussing the legislation next

BE IT ENACTED BY THE COUNCIL OF THE DISTRICT OF COLUMBIA, That this

act may be cited as the “Marijuana Legalization and Regulation Act of 2019”.

Section 2. Definitions.

For the purposes of this act, the term:

(1) “Batch” means a definite quantity of marijuana, useable marijuana, or marijuana-infused product identified by a batch number, every portion or package of which is uniform within recognized tolerances for factors that appear in the labeling.

(2) “Batch number” mean an identifier for a batch that includes the licensee by business or trade name and the District of Columbia business identifier number, and the date of harvest or processing for each lot of marijuana, useable marijuana, or marijuana-infused product.

(3) “Manufacture” means the production, preparation, propagation, compounding, conversion, or processing of a controlled substance, either directly or indirectly or by extraction from substances of natural origin, or independently by means of chemical synthesis, or by a combination of extraction and chemical synthesis, and includes any packaging or repackaging of the substance or labeling or relabeling of its container. The term “manufacture” does not include the preparation, compounding, packaging, repackaging, labeling, or relabeling of a controlled substance by a practitioner in the course of a practitioner’s professional practice, or by a practitioner for the purpose of research, teaching, or chemical analysis £ind not for sale.

(4) “Marijuana” means all parts of the plant Cannabis, whether growing or not, with a THC concentration greater than 0.3 percent on a dry weight basis; the seeds thereof; the resin extracted from any part of the plant; and every compound, manufacture, salt, derivative, mixture, or preparation of the plant, its seeds or resin. The term “retail marijuana” does not include the mature stalks of the plant, fiber produced from the stalks, oil or cake made from the seeds of the plant, any other compound, manufacture, salt, derivative, mixture, or preparation of the mature stalks (except the resin extracted therefrom), fiber, oil, or cake, or the sterilized seed of the plant which is incapable of germination, or the weight of any other ingredient combined with marijuana to prepare topical or oral administrations, food, drink, or other product.

(5) “Marijuana products” means marijuana, marijuana concentrates, including hashish, or marijuana-infused products.

(6) “Mature plant” means a plant that is flowering.

(7) “Plant” means any living organism that produces its own food through photosynthesis and has observable root formation or is in growth material; it does not include such an organism that is in the process of drying or “curing” has been uprooted or is not planted in soil or a hydroponic system.

(8) “THC potency” means percent of delta-9 tetrahydrocannabionol content per dry weigh of any part of the plan Cannabis, or per volume or weight of marijuana product.

(9) “Transfer” means to grant, convey, hand over, assign, sell, exchange, or barter in any manner or by any means.

(10) “Transfer without remuneration” means a transfer not in exchange for anything of value, including money, real property, tangible and intangible personal property, contract rights, choses in action, services, and any rights of use or employment promises or agreements connected therewith. A transfer without remuneration includes a transfer in which a group of individuals over 21 years of age pool money which one individual will use to purchase retail marijuana products that are subsequently apportioned based on the money pooled. A transfer without remuneration does not include the transfer of marijuana contemporaneously with another transaction for remuneration between the same parties, a gift of marijuana offered or advertised in conjunction with an offer for sale of goods or services, or a gift of marijuana that is contingent upon a separate transaction for goods or services.

(11) “Unprocessed marijuana” means marijuana at the time of the first transfer or sale from a retail marijuana cultivation facility to a retail marijuana product manufacturing facility or a retail marijuana store.

Section 3

(a) Notwithstanding any other law, for an individual who is at least 21 years of age, the following acts shall not constitute a civil or criminal offense under District law or be a basis for seizure or forfeiture of assets under District laws:

(1) Possessing, displaying, purchasing, or transporting 2 ounces or less of dried marijuana, marijuana-infused products containing 1,000 miligrams or less of THC, or 10 grams or less of marijuana concentrate;

(2) Consumption of marijuana;

(3) Possessing, growing, processing or transporting no more than 6 marijuana plants, no more than 3 of which may be mature plants, and possession of the marijuana produced by the plants on the premises where the plants were grown, provided that the growing takes place in an enclosed, locked space and is not conducted publicly;

(4) Manufacturing, selling, possessing, displaying, purchasing, or transporting marijuana paraphernalia;

(5) Transfer without remuneration of 2 ounces or less of dried marijuana, marijuana-infused products containing 1,000 milligrams or less of THC, or 10 grams or less of marijuana concentrate to an individual who is at least 21 years of age; or

(6) Assisting another individual who is at least 21 years of age in any of the acts 101 described in this subsection.

(b)(1) For an individual who has not reached 21 years of age, the acts described in subsection (a) of this section shall not constitute a civil or criminal offense under District law or be a basis for seizure or forfeiture of assets under District laws, but shall constitute a civil infraction.

(2) An individual who has not reached 21 years of age and who commits an act described in subsection (a) of this section shall be subject to a civil fine of $25, or the performance of community service if unable to pay, and seizure of any marijuana and paraphernalia visible to the police officer at the time of the civil violation.

(A) If the individual in this paragraph is under 18 years of age, the Office of Administrative Hearings shall mail a copy of the notice of violation to the parent or guardian of the person to whom the notice of violation is issued at the address provided by the person at the time the citation is issued pursuant to § 48-1202.

(3) For the purposes of this subsection, the term “civil violation” shall have the same meaning as a civil Notice of Violation for the purposes of § 16-2333(a)(l A).

(4) Except as provided in this subsection, the District shall not request or impose any other form of penalty, sanction, forfeiture, or disqualification for violations described in this paragraph; provided, that this paragraph does not apply to District government employers if drug use is specifically prohibited as a condition of employment, nor shall this paragraph apply to Unit A of Chapter 25 of Title 7 [§ 7-2501.01 et seq.] and Chapter 45 of Title 22 [§ 22-4501 et 121 seq.].

(c) Nothing in this section shall provide a defense to:

(1) Claims of negligence or professional malpractice relating to performance of acts while under the influence of marijuana products;

(2) Charges of operating or being in physical control of a vehicle while under the influence of an intoxicating drug (§ 50-2201.05(b)( 1 )(A)(i)(II)); or

(3) Operating or being in physical control of any vessel or watercraft under the influence of an intoxicating drug (§ 25-1004(a)(3)).

(4) All local education agencies shall adopt appropriate policies and rules that prohibit the use of all tobacco products and all retail marijuana or retail marijuana products authorized by this act, on school property by students, teachers, staff, and visitors and that provide for the enforcement of these policies.

(d) For the purposes of § 16-803.02 of the District of Columbia Official Code, all violations of the District of Columbia Uniform Controlled Substances Act of 1981, effective August 5, 1981 (D.C. Law 4-29; D.C. Official Code § 48-901.02 et seq.) relating solely to marijuana or marijuana paraphernalia that occurred or were alleged to have occurred prior to the effective date of this act shall be considered decriminalized.

(1) For a person arrested, prosecuted, or convicted for a violation or alleged violation described in subsection (d) of this section, the Clerk of the Court shall:

(A) Search diligently for and expunge each court record related to the person’s arrest, prosecution, and conviction, as applicable; provided that in a case involving co-defendants, the Clerk may require expungement of only those records, or portions thereof, relating solely to the person, and shall require redaction of the person’s name to the extent practicable from records that are not expunged, but need not require redaction of references to the person that appear in a transcript of court proceedings involving the co-defendants;

(B) Send to the prosecutor, any law enforcement agency, and any pretrial, corrections, or community supervision agency a notice of expungement and instructions for expungement of each record that the entity keeps as to the arrest and charges; and

(C) Advise in writing the person entitled to expungement of the actions undertaken.

(2) Within 30 days after receipt of the notice described in subsection (d)(1) of this section, the prosecutor, any law enforcement agency, and any pretrial, corrections, or community supervision agency shall:

(A) Search diligently for and expunge each record related to the arrest, confinement, or charges; and

(B) Advise in writing the person entitled to expungement of compliance.

Section 4. The District of Columbia Uniform Controlled Substances Act of 1981, effective August 5, 1981 (D.C. Law 4-29; D.C. Official Code § 48-901.02 et seq.), is amended as follows:

(a) Section 208 (D.C. Official Code § 48-902.08) is amended as follows:

(1) Subparagraph (a)(6) is amended to read as follows:

“(a)(6) Cannabis only when it relates to:

“(1) Driving or boating under the influence of drugs pursuant to D.C. Official Code § 50-2206.01; and

“(2) Possession or distribution that is not pursuant to the Legalization of Possession of Minimal Amounts of Marijuana for Personal Use Initiative of 2014, effective February 26, 2015 (D.C. Law 20-153; D.C. Official Code § 48-904.01(a)(1)(A) et seq) or section 6 of the Marijuana Legalization and Regulation Act of 2019.”

(b) Section 206 (D.C. Official Code § 48-902.06) is amended as follows:

(1) Subparagraph (1)(F) is amended to read as follows:

“(1)(F) Hashish only as it relates to D.C. Official Code § 50-2206.01 for the purpose of defining controlled substances as they relate only to driving under the influence of drugs.”

(c) Section 401 (D.C. Official Code § 48-904.01) is amended as follows:

(1) Subsection (g) is amended by striking the phrase “marijuana, or depressant or stimulant drugs” and inserting the phrase “or depressant or stimulant drugs” in its place.

Section 5. The Drug Paraphernalia Act of 1982, effective September 17, 1983 (D.C Law 4- 177 419; D.C. Official Code § 48-1101 er seq.), is amended as follows:

(a) Section 2(3) (D.C. Official Code § 48-1101(3)) is amended as follows:

(1) Subparagraph (G) is repealed.

(2) Subparagraph (L) is amended as follows:

(A) Strike the phrase “Cannabis, cocaine, hashish, hashish oil, or any other controlled substance” and insert the phrase “cocaine or any other controlled substance” in its place.

Section 6. Title 25 of the District of Columbia Official Code is amended as follows:

(a) A new section 25-105 is added to read as follows:

Ҥ 25-105. Sale of marijuana products without a license prohibited.

“(a) No person shall sell marijuana products in the District without having first obtained an appropriate license as required by this title.

“(b) No marijuana cultivator or marijuana products manufacturer located within the District shall offer any marijuana products for sale to, or solicit orders for the sale of any marijuana products from, any person not licensed under this title, irrespective of whether the sale 192 is to be made inside or outside of the District.

“(c) No licensee or person shall ship, import, export or cause to be shipped or imported 1into or exported outside of the District any marijuana products.

“(d) No retail marijuana store licensee shall purchase, sell, or offer for sale any marijuana products obtained from any person not licensed under this title.

“(e) Nothing in this section shall be construed to prohibit any conduct permitted by Chapter 16B of Title 7 [§ 7-1671.01 et seq.]

(b) Section 25-104(c) is amended to read as follows:

“A license to sell alcoholic beverages or marijuana products, except those permitted by Chapter 16B of Title 7 [§ 7-1671.01 et seq.], in the District can be granted only by the Board upon completion of the application and review process as contained in this title.”

(c) A new subchapter III is added to read as follows:

“SUBCHAPTER III. CLASSIFICATION OF RETAIL MARIJUANA LICENSES “§ 25-130. General Provisions.

“(a) For the purpose of regulating the cultivation, manufacture, distribution, sale, consumption, and testing of retail marijuana and retail marijuana products, the Board in its discretion, upon receipt of an application in the prescribed form, may issue and grant to the applicant a license from any of the following classes:

“(1) Retail marijuana cultivation facility license;

“(2) Retail marijuana products manufacturing license;

“(3) Retail marijuana store license;

“(4) Retail marijuana testing facility license;

“(5) Retail on-premises consumption facility license;

“(6) Occupational licenses and registrations for owners, managers, operators, employees, contractors, and other support staff employed by, working in, or having access to restricted areas of licensed premises, as determined by the Board.

“(b) A dual medical marijuana dispensary and retail marijuana store shall maintain separate inventory and record keeping, and shall present a plan to the Board regarding its plan to ensure it will continue to meet the needs of medical patients including minors.

“(c) A license issued under this section shall be valid for a term of three years and may be renewed upon completion of the procedures set forth by the Board and payment of the required fees.

“(d) The Board may revoke or elect not to renew any license if it determines that the licensed premises have been inactive or abandoned without good cause, for at least six months.

“(e) The Board shall require a complete disclosure of all persons having, a direct or indirect financial interest, and the extent of such interest, in each license issued under this subchapter.

“(f) All employees or contractors of facilities licensed under this subchapter shall be 21 years of age or older.

“(g) The Board shall have the authority to alter license and application fees established by the act and create additional licenses, permits, endorsements and application fees subject to Council approval in accordance with D.C. Code § 25-211(b).

Ҥ 25-131. Retail marijuana cultivation facility license requirements.

“(a) A retail marijuana cultivation facility license shall authorize the licensee to cultivate retail marijuana for sale and distribution to licensed retail marijuana stores, retail marijuana products manufacturing licensees, or other retail marijuana cultivation facilities.

“(b) A retail marijuana cultivation facility shall remit any applicable excise tax due in accordance with section 9 of this act based on the average wholesale prices set by the Board in consultation with the Office of the Chief Financial Officer.

“(c) A retail marijuana cultivation facility shall track the marijuana it cultivates from seed or immature plant to wholesale purchase. Prior to delivery of any sold retail marijuana the retail 243 marijuana cultivation facility shall provide evidence that it paid any applicable excise tax on retail marijuana due pursuant to section 9 of this act.

“(d) A retail marijuana cultivation facility may provide, except as required by section 7 subsection (8) of this act, a sample of its products to a facility that has a marijuana testing facility license from the Board for testing and research purposes. A retail marijuana cultivation facility shall maintain a record for five years of what was provided to the testing facility, the identity of the testing facility, and the testing results. The Board may approve alternative methods for a retail marijuana cultivation facility to test its products until one or more testing facilities in the District of Columbia become operational.

“(e) Retail marijuana or retail marijuana-infused products rnay not be consumed on the premises of a retail marijuana cultivation facility.

“(f)(1) The maximum application fee for the retail marijuana cultivation facility license shall be $5,000.

“(2) The application fee for a person who is currently operating in good standing as a registered medical marijuana cultivation center pursuant to the Legalization of Marijuana for Medical Treatment Amendment Act of 2010, effective July 27, 2010 (D.C. Law 18-210; D.C. Official Code ss. 7-1671.01 et seq.), shall be $1,000. This subsection (f)(2) is repealed, effective 260 December 31, 2020.

“(g) If a retail marijuana cultivation facility licensee intends to manufacture retail marijuana products, a separate application shall be filed. A person may operate a licensed marijuana cultivation facility and licensed retail marijuana products manufacturing facility in the same location.

“(h) A retail marijuana cultivation facility license shall not be leased or subcontracted in part or in whole.

Ҥ 25-132. Retail marijuana products manufacturing license requirements.

“(a) A retail marijuana products manufacturing license shall authorize the licensee to manufacture marijuana products.

“(b) A retail marijuana products manufacturing licensee may cultivate its own marijuana if it obtains a retail marijuana cultivation facility license, or it may purchase marijuana from a licensed retail marijuana cultivation facility. A retail marijuana products manufacturer shall track all of its marijuana from the point when it is either transferred from its retail marijuana cultivation facility or the point when it is delivered to the retail marijuana products manufacturer from a licensed retail marijuana cultivation facility to the point of transfer to a licensed retail marijuana store.

“(c) A retail marijuana products manufacturer shall not accept any marijuana purchased from a retail marijuana cultivation facility unless the retail marijuana products manufacturer is provided with evidence that any applicable excise tax due pursuant to section 9 of this act, was paid.

“(d) In addition to any rules regarding marijuana products manufacturing promulgated by the Board pursuant to this title, a licensed retail marijuana manufacturer shall adhere to the following:

“(1)(A) Marijuana products shall be prepared on a licensed premises that is used exclusively for the manufacture and preparation of marijuana products and using equipment that is used exclusively for the manufacture and preparation of marijuana products;

“(B) A retail marijuana products manufacturing licensee may share the same premises as a medical marijuana-infused products manufacturing licensee so long as a virtual or physical separation of the inventory is maintained pursuant to any rules promulgated by the Board;

“(2) All licensed premises on which marijuana products are manufactured shall meet the sanitary standards for marijuana product preparation promulgated pursuant to section 7(b)(7) of this act;

“(3) The marijuana products shall be sealed, packaged, and conspicuously labeled in compliance with this act and any rules promulgated pursuant to this act by the Board;

“(4)Marijuana products may not be consumed on the premises of a retail marijuana products manufacturing facility;

“(5) A retail marijuana products manufacturer may provide, except as required by section 7(b)(8) of this act, a sample of its products to a facility that has a marijuana testing facility license from the Board for testing and research purposes. The Board may approve alternative methods for a retail marijuana products manufacturer to test its products until one or more testing facilities in the District of Columbia become operational. A retail marijuana products manufacturer shall maintain a record for five years of what was provided to the testing 304 facility, the identity of the testing facility, and the testing results;

“(6) An edible marijuana product shall list its ingredients and compatibility with dietary practices; and

“(7) All marijuana products that require refrigeration to prevent spoilage must be stored and transported in a refrigerated environment.

“(e) A retail marijuana products manufacturer shall not:

“(1) Add any marijuana to a food product where the manufacturer of the food product holds a trademark to the food product’s name; except that a manufacturer may use a trademarked food product if the manufacturer uses the product as a component or as part of a recipe and where the marijuana product manufacturer does not state or advertise to the consumer that the final marijuana product contains trademarked food product;

“(2) Intentionally or knowingly label or package a marijuana product in a manner that would cause a reasonable consumer confusion as to whether the marijuana product 317 was a trademarked food product;

“(3) Label or package a product in a manner that violates any federal trademark law or regulation; or

“(4) Label or package a product in a manner that markets to minors.

“(f) The maximum application fee for the retail marijuana products manufacturing license shall be $5,000.

“(g) A retail marijuana products manufacturing license shall not be leased or subcontracted in part or in whole.

Ҥ 25-133. Retail marijuana store license requirements.

“(a) A retail marijuana store license shall authorize the licensee to sell marijuana products for off-premises consumption at a retail marijuana store. A retail marijuana store license shall be issued only to an establishment located inside of a physical building.

“(b) A retail marijuana store licensee shall transact with a retail marijuana products manufacturing licensee for the purchase of marijuana products which may occur upon either licensee’s licensed premises.

“(c) A retail marijuana store shall purchase marijuana products from a licensed retail marijuana cultivation facility. A transaction between a retail marijuana store and a retail marijuana cultivation facility license for the purchase of retail marijuana may occur upon either licensee’s licensed premises

“(d) A retail marijuana store shall not accept any marijuana purchased from a retail marijuana cultivation facility unless the retail marijuana store is provided with evidence that any applicable excise tax due pursuant to section 9 of this act, was paid.

“(e) A retail marijuana store shall track all of its marijuana products from the point that they are transferred from a retail marijuana cultivation facility or retail marijuana products manufacturer to the point of sale.

“(f) Prior to initiating a sale, the employee of the retail marijuana store making the sale shall verify that the purchaser has a valid identification card showing the purchaser is 21 years of age or older. A retail marijuana store or its agent or employee shall take steps reasonably necessary to ascertain whether any person to whom the licensee sells retail marijuana or retail marijuana products if of legal age. Any person who supplies a valid identification document showing his or her age to be twenty-one years of age or older shall be of legal age.

“(g) A retail marijuana store shall not sell:

“(1) More than a 1/4 ounce of marijuana, marijuana-infused products containing more than 250 miligrams of THC, or more than 2.5 grams of marijuana concentrate, or any equivalent combination thereof during a single transaction to a person who does not have a valid identification card showing that the person is a resident of the District of Columbia; or

“(2) More than 2 ounces of marijuana, marijuana-infused products containing more than 1,000 miligrams of THC, or more than 10 grams of marijuana concentrate, or any equivalent combination thereof during a single transaction to a person who provides a valid identification card showing that the person is a resident of the District of Columbia.

“(h) All marijuana products sold at a licensed retail marijuana store shall be packaged and labeled as required by the Board.

“(i) A licensed retail marijuana store may only sell marijuana products, marijuana accessories, non-consumable products such as apparel, and marijuana related products such as childproof packaging containers.

“(j) A licensed retail marijuana store shall not:

“(1) Sell or give away any consumable product, including but not limited to cigarettes, e-cigarettes or alcohol, or edible product that does not contain marijuana, including but not limited to sodas, candies, or baked goods; or

“(2) Sell any marijuana products that contain nicotine or alcohol.

“(k) A retail marijuana store may provide, except as required by section 7(b)(8) of this act, a sample of its products to a facility that has a marijuana testing facility license from the Board for testing and research purposes, A retail marijuana retail store shall maintain a record for five years of what was provided to the testing facility, the identity of the testing facility, and the testing results.

“(l) Marijuana products may not be consumed on the premises of a retail marijuana store.

“(m) The maximum application fee for the retail marijuana store license shall be $5,000.

“(n) A retail marijuana store license shall not be leased or subcontracted in part or in whole.

“(o) A retail marijuana store license shall be subject to the public comment and notice requirements set forth in D.C. Code §§ 25-421 and 25-423 prior to issuance.

Ҥ 25-134. Retail marijuana on-premises consumption facility requirements.

“(a) A retail marijuana on-premises consumption facility license shall authorize the licensee to sell marijuana products for on-premises consumption within the designated premises and sell or furnish marijuana paraphernalia for the purpose of on-premises consumption within the designated premises regulated by the District of Columbia Alcohol Beverage Control Board and subject to review every three years.

“(b) A retail marijuana on-premises consumption facility license shall authorize the licensee to sell marijuana products purchased from a producer licensee in accordance with the provisions of this act and the rules adopted to implement and enforce it, provided that quantities available for purchase are designated for on-premises consumption.

“(c) A retail marijuana on-premises consumption facility license shall be subject to the public comment and notice requirements set forth in D.C. Code §§ 25-421 and 25-423 prior to issuance.

Ҥ 25-135. Retail marijuana testing facility requirements.

“(a) A retail marijuana testing facility license shall authorize the licensee to perform testing and research on marijuana. The facility may develop and test marijuana products.

“(b) The Board shall promulgate rules pursuant to its authority in section (7)(b)(11) of this act related to acceptable testing and research practices, including but not limited to testing, standards, quality control analysis, equipment certification and calibration, and chemical identification and other substances used in bona fide research methods.

“(c) A person who has an interest in a retail marijuana testing facility license for testing purposes obtained through this title shall not have any interest in a licensed medical marijuana dispensary, a licensed medical marijuana cultivation center, a licensed retail marijuana cultivation facility, a licensed retail marijuana products manufacturer, or a licensed retail marijuana store. A person who has an interest in a licensed medical marijuana dispensary, a licensed medical marijuana cultivation center, a licensed retail marijuana cultivation facility, a licensed retail marijuana products manufacturer, or a licensed retail marijuana store shall not have an interest in a facility that has a retail marijuana testing facility license.

“(d) The maximum application fee for the retail marijuana testing facility license shall be $5,000.

“(e) A retail marijuana testing facility license shall not be leased or subcontracted in part or in whole.

Ҥ 25-136. Limits on financial interests.

“(a) No person or business entity may have a financial or voting interest of 10% or greater in more than 3 licensed retail marijuana establishments of any single category, or more than 1/2 of all licensed retail marijuana establishments of a single category, whichever is lesser.”.

(e) Section 25-206(g) is amended as follows:

(1) Redesignate the existing text as paragraph (1).

(2) Adding a new paragraph (2) to read as follows:

“(2) No member or employee of the Board, directly or indirectly, individually, or as a member of a partnership, association, or limited liability company, or a shareholder in a corporation, shall have any interest, in the cultivation, products manufacturing, or sale of retail marijuana or retail marijuana-infused products, or derive any profit or commission from any person licensed under this act to cultivate, produce retail marijuana or marijuana-infused products or sell retail marijuana or retail marijuana-infused products; provided, that a Board member or employee may purchase, transport, or keep in his or her possession retail marijuana or retail marijuana-infused products for his or her personal use or the use of the members of his or her family or guests.”.

(f) Section 25-212 is amended as follows:

(1) Redesignate the existing text as paragraph (a).

(2) Adding a new paragraph (b) to read as follows:

“(b) The new licensee orientation class established by ABRA for retail marijuana licenses shall be mandatory for all new retail marijuana licensees.”.

(g) Section 25-301 is amended by adding a new subsection (a-2) to read as follows:

“(a-2) Before issuing, transferring to a new owner, or renewing a retail marijuana license, the Board shall determine that the applicant meets all of the following criteria:

“(1) The applicant is generally fit for the responsibilities of licensure.

“(2) The applicant is at least 21 years of age.

“(3) The applicant has been a resident of the District of Columbia for at least six months before applying to receive a license.

“(4) The applicant has not been convicted, within the 10 years prior to application, of a felony that bears on fitness for licensure, except if the Board determines that the applicant is otherwise suitable to be issued a license, and granting the license would not compromise public safety. The Board shall conduct a thorough review of the nature of the crime, conviction, circumstances, and evidence of rehabilitation of the applicant, and shall evaluate the suitability of the applicant to be issued a license based on the evidence found through the review. A drug-related felony conviction prior to the effective date of this act does not bear on the fitness for licensure absent aggravating circumstances.

“(5) The applicant is the true and actual owner of the establishment for which the license is sought, and he or she intends to carry on the business for himself or herself and not as the agent of any other individual, partnership, association, limited liability company, or corporation not identified in the application.

“(6) The licensed establishment will be managed by the applicant in person or by a Board-licensed manager possessing the same qualifications required of the licensee.

“(7) The licensed establishment will not be located or operated on federal property.

“(8) The applicant has submitted an adequate security plan and has complied with all the requirements of this title and regulations issued under this title.”.

(h) Section 25-303(a) is amended by adding a new paragraphs (4) and (5) to read as follows:

“(4) No licensee under a retail marijuana store’s license shall hold an interest in a retail marijuana cultivation facility license, a retail marijuana products manufacturer license, or a retail marijuana testing facility license.

“(5) No licensee under a retail marijuana cultivation facility license or a retail marijuana products manufacturer license shall hold an interest in a retail marijuana store license or retail marijuana testing facility license.”.

(i) A new section 25-512 is added to read as follows:

Ҥ 25-512. Maximum annual fee for retail marijuana licenses.

“(a) The maximum annual fees for a retail marijuana cultivation facility license; retail marijuana products manufacturing license; retail marijuana store license; and retail marijuana 468 testing facility license shall be as follows:

License ClassCost/Year

| Retail Marijuana Cultivation Facility | $5,000 |

| Retail Marijuana Products Manufacturing | $5,000 |

| Retail Marijuana Store | $5,000 |

| On-premise Consumption Facility | $5,000 |

| Retail Marijuana Testing Facility | $5,000 |

(j) A new section 25-786 is added to read as follows:

Ҥ 25-786. Sale of retail marijuana to minors or intoxicated persons prohibited.

“(a) The sale or delivery of retail marijuana or retail marijuana infused products to the following persons is prohibited:

“(1) A person under 21 years of age, either for the person’s own use or for the use of any other person; or

“(2) An intoxicated person, or any person who appears to be intoxicated.

“(b) A licensee or other person shall not, at a licensed establishment, give, serve, deliver, or in any manner dispense retail marijuana or retail marijuana-infused product to a person under 21 years of age.

“(c) A licensee shall not be liable to any person for damages claimed to arise from refusal 486 to sell retail marijuana or retail marijuana-infused product in its establishment under the authority of this section.

“(d) Upon finding that a license has violated subsections (a) or (b) of this section in the 489 preceding 2 years:

“(1) Upon the 1st violation, the Board shall fine the licensee not less than $2,000, and not more than $3,000, and suspend the licensee for 5 consecutive days; provided, that the 5-day suspension may be stayed by the Board for one year.

“(2) Upon the 2nd violation, the Board shall fine the licensee not less than $3,000, and not more than $5,000, and suspend the licensee for 10 consecutive days; provided, that the Board may stay up to 6 days of the 10-day suspension for one year;

“(3) Upon the 3rd violation, the Board shall fine the licensee not less than $5,000, and not more than $10,000, and suspend the licensee for 15 consecutive days, or revoke the license; provided, that the Board may stay up to 5 days of the 15-day suspension for one year;

“(4) Upon the 4th violation, the Board may revoke the license; and

“(5) The Board may revoke the license of a licensed establishment that has 5 or more violation of this section within a 5-year period.”.

(k) A new section 25-833 is added to read as follows:

Ҥ 25-833. Civil penalties for retail marijuana

“(a) Within 90 days after the effective date of the act, ABRA shall submit proposed regulations setting forth a schedule of civil penalties (“schedule”) for violations of Title 25 related to retail marijuana to the Council for a 60-day period of review, including Saturdays, Sundays, holidays, and periods of Council recess. If the Council does not approve, in whole or in part, the proposed regulations by resolution within the 60-day review period, the regulations shall be deemed disapproved.

“(b) The schedule shall be prepared in accordance with the following provisions:

“(1) The schedule shall contain 2 tiers that reflect the severity of the violation for which the penalty is imposed:

“(A) The primary tier shall apply to more severe violations, including service to minors or violation of hours of sale of retail marijuana; and

“(B) The secondary tier shall apply to less severe violations, including failure to post required signs.

“(2) A subsequent violation in the same tier, whether a violation of the same provision or different one, shall be treated as a repeat violation for the purposes of imposing an increased penalty; provided, that all secondary tier infractions cited by ABRA investigators or Metropolitan Police Department Officers, during a single investigation or inspection on a single day, shall be deemed to be one secondary tier violation for the purposes of determining repeat violations under this section.

“(3) The schedule of civil penalties shall also include a comprehensive warning and violation structure, which shall include recommendations on which violations of the act or regulations shall require a warning for a first-time violation prior to penalty.

“(c) The minimum penalties for violations shall follow in accordance with section § 25-830 of the D.C. Code.

“(1) There shall be no warning for a first time violation of § 25-786.”.

(j) Section 25-1002 subsection (a) is amended to read as follows:

“(a) No person who is under 21 years of age shall purchase, attempt to purchase, possess, or consume an alcoholic beverage or retail marijuana product in the District, except as provided under subchapter IX of Chapter 7. This subsection shall not apply to a person under 21 years of who is acting under the direction of ABRA for the purpose of investigating possible violations of laws that prohibit the sale of retail marijuana or retail marijuana-infused product to persons who are under 21 years of age.”.

(m) Section 25-1002 subsection (b)(1) and (b)(2) is amended to read as follows;

“(b)(1) No person shall falsely represent his or her age, or possess or present as proof of age an identification document which is in any way fraudulent, for the purpose of purchasing, possessing or consuming an alcoholic beverage, retail marijuana, or a retail marijuana-infused product in the District.

“(2) No person shall present a fraudulent identification document for the purpose of

entering an establishment possessing an on-premises retailer’s license, an Arena C/X license, a temporary license, a retail marijuana cultivators license, a retail marijuana products manufacturer license, an on-premises consumption facility license, or a retail marijuana store license.”.

Section 7. Duties of ABRA regarding marijuana regulation.

(a) The Alcoholic Beverage Regulation Administration (“ABRA”) shall implement and maintain a secure, electronic seed-to-sale tracking and reporting system, that tracks retail marijuana from either seed or immature plant stage until the sale of the marijuana product to a customer at a retail marijuana store, to ensure that no marijuana grown or processed by a licensed retail marijuana establishment is sold or otherwise transferred except by a retail marijuana store. The system shall be web-based and accessible by ABRA, the Office of the Chief Financial Officer, law enforcement and licensees. ABRA may charge licensees an annual fee to maintain the cost of the system.

(b) ABRA, subject to provisions of this act, shall adopt rules within 180 days of the effective date of this act to establish the procedures and criteria necessary to implement the following:

(1) Determining, in consultation with the Office of Planning, the maximum number of retail marijuana operations that may be licensed in the District, taking into consideration:

(A) Population distribution and future growth;

(B) Security and safety issues;

(C) The provision of adequate access to license sources of marijuana products to discourage purchases from the illegal market;

(D) The need to balance such access, and the jobs and economic opportunity created by marijuana businesses, with the need to avoid an undue concentration of businesses in a neighborhood or Ward;

(2) Labeling requirements for retail marijuana and retail marijuana products sold by a retail marijuana store license, to include but not be limited to:

(A) The license number of the retail marijuana cultivation facility;

(B) The license number of the retail marijuana store;

(C) The batch numbers of the retail marijuana;

(D) THC potency of the marijuana, useable marijuana, or marijuana-infused product and the potency of other cannabinoids or other chemicals;

(E) Amount of THC per serving and the number of servings per package for marijuana products;

(F) A net weight statement;

(G) A list of ingredients and possible allergens for retail marijuana-infused or edible marijuana products;

(H) A nutritional fact panel for edible marijuana products;

(I) A recommend use by or expiration date for retail marijuana products;

(J) Medically and scientifically accurate statement about the health and safety risks posed by marijuana use;

(K) A universal symbol indicating the package contains marijuana;

(3) Establishing reasonable time, place, and manner restrictions for selling or consuming marijuana products;

(4) Establishing reasonable time, place, and manner restrictions and requirements regarding signage, marketing, and advertising of marijuana products, taking into consideration:

(A) Minimizing exposure of people under twenty-one years of age to the advertising; and

(B) The inclusion of medically and scientifically accurate statements about the health and safety risks posed by marijuana use in the advertising, merchandising and packaging;

(5) Specifying and regulating the time and periods when, and the manner, methods, and means by which, licensees shall transport and deliver marijuana products within the District of Columbia;

(6) Inspection requirements for locations used by marijuana cultivation, manufacture and retail establishments to ensure proper conditions of sanitation;

(7) Sanitary requirements for retail marijuana establishments, including but not limited to sanitary requirements for the preparation of retail marijuana products;

(8) Health and safety regulation and standards for the manufacture of retail marijuana products and the cultivation of retail marijuana;

(9) Limitations on the display of retail marijuana products;

(10) Regulation of the storage of, warehouses for, and transportation of retail marijuana and retail marijuana products;

(11 )(A) Establishing an independent testing and certification program for marijuana products, within an implementation time frame established by ABRA, requiring licensees to test marijuana to ensure at a minimum that products sold for human consumption do not contain contaminants that are injurious to health and ensure correct labeling;

(B) ABRA shall determine the protocols and the frequency of marijuana testing by licensees;

(C) Testing shall include, but not be limited to, analysis for residual solvents, poisons, or toxins; harmful chemicals; dangerous molds or mildew; filth; and harmful microbials such as E. Coli or salmonella and pesticides;

(D) In the event that test results indicate the presence of quantities of any substance determined to be injurious to health, such products shall be immediately quarantined and immediate notification to ABRA shall be made. The contaminated product shall be documented and properly destroyed;

(E) Testing shall also verify THC potency representations for correct labeling;

(F) ABRA shall determine an acceptable variance for potency representation and procedures to address potency misrepresentations; and

(G) The Department of Health shall provide to ABRA standards for licensing laboratories pursuant to the requirements outlined in subsection (12)(A) for marijuana and marijuana products;

(12) Procedures for identifying, seizing, confiscating, destroying, and donating to law enforcement for training purposes all marijuana, useable marijuana, and marijuana-infused products produced, processed, packaged, labeled, or offered for sale in this District of Columbia that do not conform in all aspects to the standards prescribed by this act or the rules of the ABRA.

(13) Establishing the process and qualifications for licensing and/or registering owners, managers, operators, employees, contractors, and other support staff employed by, working in, or having access to restricted areas of licensed premises of retail marijuana cultivation facilities, retail marijuana products manufacturing facilities, retail marijuana stores, and retail marijuana testing facilities, provided that such process and qualifications shall include special consideration to promote diversity among licensees and to ameliorate the effects of the previous criminalization of marijuana, including the creation of additional points that a licensee may earn on an application to prioritize allocation of licenses to applicants who are African American, long-time District of Columbia residents, formerly incarcerated, or otherwise appropriate for this special consideration;

(14) Determining the books and records to be created and maintained by licensees, the reports to be made to ABRA, and the inspection of books and records;

(15) Establishing security requirements for any premises licensed pursuant to this act, including at minimum lighting, physical security, video, and alarm requirements;

(16) In conjunction with the Office of the Chief Financial Officer, the reporting and transmittal of monthly sales tax payments by retail marijuana stories and any applicable excise tax payments by retail marijuana cultivation facilities to the Office of the Chief Financial Officer;

(17) Authorization for the Office of the Chief Financial Officer to have access to licensing information to ensure sales, excise, and income tax payment and the effective administration of section 9 of this act;

(18) Determining the process and procedure for renewal of the retail marijuana cultivation facility license, the retail marijuana products manufacturing license; the retail marijuana store license; the on-premise consumption facility license; the retail marijuana testing facility license; and any licenses, registration or fees ABRA requires for owners, managers, operators, employees, contractors, and other support staff employed by, working in, or having access to restricted areas of licensed premises;

(19) Establishing procedures and a schedule of penalties for enforcement proceedings to occur before the Board and for issuing and appealing citations for violations of the act and regulations promulgated pursuant to this act;

(20) Establishing rules concerning dual medical marijuana dispensary and retail marijuana store, in which the dispensary sells medical marijuana to persons under the age of twenty-one years of age or older; and

(21) Establishing procedures concerning the conversion of medical marijuana cultivation centers and medical marijuana dispensary licenses to retail marijuana licenses permitted under the act, including requirements for continued provision of appropriate medical marijuana products to meet the needs of patients.

(c) For the purpose of carrying into effect the provisions of this act according to their true intent or of supplying any deficiency therein, ABRA may adopt rules which are not inconsistent with the spirit of this act as are deemed necessary or advisable, including but not limited to the following:

(1) The equipment and management of retail outlets and premises where marijuana is produced or processed, and inspection of the retail outlets and premises; and

(2) The manner of giving and serving notices required by this act or rules adopted to implement or enforce it;

(3) Establishing rules concerning hearing processes and procedures for filing protests, enforcement proceedings, and other hearing types;

(4) Establishing procedures for an inactive marijuana retail license to be placed in safekeeping with the Board; and

(5) Any other regulation deemed necessary to administer the marijuana program or otherwise promote the health, safety, and welfare of the public.

(d) On or before January 15, 2020, and on or before October 1 each year thereafter, ABRA in conjunction with the Office of the Chief Financial Officer shall submit a report to the Council and the Mayor on:

(1)The number of licenses issued including by license category;

(2) An overview of the retail marijuana and retail marijuana products markets; including but not limited to actual and anticipated market demand and market supply;

(3) Detailing the amount of revenue generated by medical and retail marijuana, including applicable application and license fees, fines, excise taxes, sales taxes, and other fees;

(4) Detailing the expenses incurred by ABRA;

(5) The number of applications for conversion from medical marijuana licensees 691 to retail marijuana establishments; and

(6) The enforcement measures taken against licensees licensed pursuant to this act for violations of the act and regulations promulgated pursuant to this act.

Section 8. Marijuana Monies.

(a) There shall be a non-lapsing fund, known as the dedicated marijuana fund, which

shall consist of all retail marijuana excise taxes, and retail marijuana sale taxes.

(b) All retail marijuana license fees, fines, penalties, forfeitures, and all other monies, income, or revenue received by ABRA from retail marijuana regulation activities shall be deposited and credited to a non-lapsing fund known as the ABRA retail marijuana administrative and enforcement operations fund. All fees deposited into the ABRA retail marijuana administrative and enforcement operations fund shall not revert to the General Fund of the District of Columbia at the end of any fiscal year or any other time, but shall be continually available for the uses and purposes set forth in this subsection, subject to authorization by Congress in an appropriations act. The funds in the ABRA retail marijuana administrative and enforcement operations fund shall be used to fund the expenses of ABRA in the discharge of its 706 administrative and regulatory duties.

(c) The Mayor shall submit to the Council, as part of the annual budget, a budget for ABRA to implement the act and a request for an appropriation for expenditures from the ABRA retail marijuana administrative and enforcement operations fund. The estimate shall include expenditures for salaries, fringe benefits, overhead charges, training, supplies, technical, professional, and any and all other services necessary to discharge the duties and responsibilities of ABRA under the act.

(d) Beginning in fiscal year 2020, and each fiscal year thereafter all monies deposited in the dedicated marijuana fund shall be disbursed every three months by the D.C.. Treasurer to the following:

(1) The First $1,000,000 shall be disbursed to the D.C. Department of Behavioral Health:

(A) $500,000 for implementation and maintenance of evidence-based programs and practices aimed at the prevention or reduction of maladaptive substance use, substance-use disorder, substance abuse or substance dependence among middle school and high school age students, whether as an explicit goal of a given program or practice or as a consistently corresponding effect of its implementation; and

(B) $500,000 for evidence-based in-patient and out-patient programs to address and reduce maladaptive substance use, substance-use disorder, substance abuse or

substance dependence among minors and adults;

(2) The next $750,000 shall be disbursed to the Department of Small and Local Business Development for the implementation, in collaboration with the ABRA, of a retail marijuana business incubator and technical assistance programs to support the goals of this act in bringing the benefits of marijuana legalization and regulation to those formerly harmed by criminalization;

(3) The next $2,000,000 shall be to disbursed via a Community Reinvestments grants program to qualified community-based nonprofit organizations to support job placement, mental health treatment, system navigation services, legal services to address barriers to reentry and record sealing, linkages to medical care, and other services for communities disproportionately affected by past federal and District drug policies. The Mayor shall solicit input from community-based job skills, job placement, and legal service providers with relevant expertise as to the administration of the grants program, and shall periodically evaluate the efficacy of the funded programs; and

(4) Any amount in excess received and collected shall be transferred to the general fund.

Section 9. Retail Marijuana Taxation.

(a) Section 47-2002(a)(7) of the District of Columbia Official Code is amended to add a new subsection (8) to read as follows:

“(8) The rate of tax shall be 10% of the gross receipts from the sale of or charges for retail marijuana or retail marijuana products.

“(B) The proceeds of the tax collected under subparagraph (A) of this paragraph shall be deposited in a dedicated fund established in section 8 of this Act.”.

(b)(1) There shall be levied, collected, and paid, in addition to the sales tax imposed pursuant to subsection (a) of this section, an excise tax on the first sale or transfer of unprocessed retail marijuana by a retail marijuana cultivation facility. The tax shall be imposed at the time when the retail marijuana cultivation facility first sells or transfers unprocessed retail marijuana from the retail marijuana cultivation facility to a retail marijuana product manufacturing facility, a retail marijuana store, or another retail marijuana cultivation facility. The rate shall be:

(A) $40 per ounce on all cannabis flowers;

(B) $10 per ounce on all parts of cannabis other than cannabis flowers and immature cannabis plants;

(C) $25 per immature cannabis plant; and

(D) For quantities of less than an ounce the rates in paragraphs (A) through (C) shall apply proportionately.

(2) The proceeds of the tax collected under this paragraph shall be deposited in a dedicated fund established in section 8 of this Act.

(d) The Office of the Chief Financial Officer may require retail marijuana cultivation facilities, on-premises consumption facilities and retail marijuana stores to file tax returns and remit payments due pursuant to subsection (a) and (b) of this section electronically. The Office of Chief Financial Officer shall promulgate rules governing electronic payment and filing.

Section 10. Medical Marijuana.

(a) Each regulation, standard, rule, notice, order and guidance promulgated or issued by the Mayor pursuant to the Legalization of Marijuana for Medical Treatment Amendment Act of 2010, effective July 27, 2010 (D.C. Law 18-210; D.C. Official Code ss. 7-1671.01 et seq.) shall remain in effect according to its terms, except to the extent otherwise provided under this act, inconsistent with any provision of this act, or revised by the Mayor.

(b) Any person holding a license pursuant to the Legalization of Marijuana for Medical Treatment Amendment Act of 2010, effective July 27, 2010 (D.C. Law 18-210; D.C. Official Code ss. 7-1671.01 et seq.), shall maintain all rights under the license for the duration of the license.

Section 11. Driving under the influence.

(a) Section § 50-1901 of the Comprehensive Anti-Drunk Driving Amendment Act of 1991 (D.C. Law 9-96; D.C. Official Code § 50-1901 et seq) is amended to read as follows:

“(18) “Specimen” means that quantity of a person’s blood, breath, oral fluid or urine necessary to conduct chemical testing to determine alcohol or drug content. A single specimen may be comprised of multiple breaths into a breath test instrument if such is necessary to complete a valid breath test, or a single blood draw or single urine or oral fluid sample regardless of how many times the blood or urine or oral fluid sample is tested. As used in this paragraph, “oral fluid” means all secretions from a person’s oral cavity.”.

(b) Section § 50-1903(a) is amended to read as follows:

“(a) Only a medical professional acting at the request of a law enforcement officer may withdraw blood, subject to the provisions of this chapter, for the purpose of determining the alcohol or drug content thereof. This limitation shall not apply to the taking of breath or urine or oral fluid specimens.”.

(c) Section § 50-1904.01 is amended to read as follows:

“(a)When a law enforcement officer has reasonable grounds to believe that a person was operating or in physical control of a vehicle within the District while intoxicated or while the person’s ability to operate a vehicle is impaired by the consumption of alcohol or a drug or a combination thereof, the law enforcement officer may, without making an arrest or issuing a violation notice, request that the person submit to a preliminary breath test or oral fluid, to be administered by the law enforcement officer, who shall use a device which the Mayor has approved by rule for that purpose.

“(b) Before administering the test, the law enforcement officer shall advise the person to be tested that the preliminary breath test or oral fluid test is voluntary and that the results of the test will be used to aid in the law enforcement officer’s decision whether to arrest the person.

“(c) The results of the preliminary breath test or oral fluid test shall be used by the law enforcement officer to aid in the decision whether to arrest the person, and the results of the test shall not be used as evidence by the District in any prosecutions and shall not be admissible in any judicial proceeding except in any judicial or other proceeding in which the validity of the arrest or the conduct of the law enforcement officer is an issue.”.

(d) Section § 50-1904.02(a)(1) is amended to read as follows:

“(1) Except as provided in paragraph (2) of this subsection, be deemed to have given his or her consent, subject to the provisions of this chapter, to submitting 2 specimens for chemical testing of the person’s blood, breath, oral fluid or urine, for the purpose of determining alcohol or drug content; and

(e) Section § 50-1904.02 subsection (a)(2) and (b) is amended to read as follows:

“(a)(2) Submit 2 specimens for chemical testing of his or her blood, breath, oral fluid or 837 urine for the purpose of determining alcohol or drug content when he or she is involved in a collision in the District.

“(b) When a person is required to submit specimens for chemical testing pursuant to subsection (a) of this section, a law enforcement officer shall elect which types of specimens will 841 be collected from the person and the law enforcement officer or a medical professional shall collect the specimen subject to the restriction in § 50-1903(a); provided, that the person may object to a particular type of specimen collection for chemical testing on valid religious or medical grounds. If a person objects to blood collection on valid religious or medical grounds, that person shall only be required to submit breath, oral fluid or urine specimens for collection.”.

(f) Section § 50-1905(d) is amended to read as follows:

“(d)(1) If a person under arrest refuses to submit specimens for chemical testing as provided in § 50-1904.02(a) and the person was involved in a collision that resulted in a fatality, except as provided in paragraph (2) of this subsection, a law enforcement officer may employ whatever means are reasonable to collect blood or oral fluid specimens from the person if the law enforcement officer has reasonable grounds to believe that the person was intoxicated or under the influence of alcohol or of any drug or any combination thereof.

“(2) If a person required to submit blood testing under paragraph (1) of this subsection objects on valid religious or medical grounds, that person shall not be required to submit blood specimens but the law enforcement officer may employ whatever means are reasonable to collect breath, oral fluid or urine specimens from the person if the law enforcement officer has reasonable grounds to believe that the person was intoxicated or under the influence of alcohol or of any drug or any combination thereof.

(g) Section § 50-1909 is amended to read as follows:

Ҥ 50-1909. Preliminary breath or oral fluid test.

“(a) When a law enforcement officer has reasonable grounds to believe that a person is or has been operating or in physical control of a watercraft within the District while intoxicated or while the person’s ability to operate a watercraft is impaired by the consumption of alcohol or a drug or a combination thereof, the law enforcement officer may, without making an arrest or issuing a violation notice, request that the person submit to a preliminary breath test or oral fluid test, to be administered by the law enforcement officer, who shall use a device which the Mayor has approved by rule for that purpose.

“(b) Before administering the test, the law enforcement officer shall advise the person to be tested that the test is voluntary and that the results of the test will be used to aid in the law enforcement officer’s decision whether to arrest the person.

“(c) The results of the preliminary breath test or oral fluid test shall be used by the law enforcement officer to aid in the decision whether to arrest the person, and the results of the test shall not be used as evidence by the District in any prosecutions and shall not be admissible in any judicial proceeding except in any judicial or other proceeding in which the validity of the 875 arrest or the conduct of the law enforcement officer is an issue.”.

(h) Section § 50-1910 is amended to read as follows:

“(a) Except as provided in subsection (b) of this section, any person who operates or who is in physical control of any watercraft within the District and a law enforcement officer has reasonable grounds to believe that the person is operating or in physical control of a watercraft while intoxicated or while the person’s ability to operate a watercraft is impaired by the consumption of alcohol or a drug or a combination thereof, after arrest shall:

“(1) Except as provided in paragraph (2) of this subsection, be deemed to have given his or her consent, subject to the provisions of this chapter, to submitting 2 specimens for chemical testing of the person’s blood, breath, oral fluid or urine, for the purpose of determining 885 alcohol or drug content; and

“(2) Submit 2 specimens for chemical testing of his or her blood, breath, oral fluid or urine for the purpose of determining alcohol or drug content when he or she is involved in a collision in the District.

“(b) When a person is required to submit specimens for chemical testing pursuant to subsection (a) of this section, a law enforcement officer shall elect which types of specimens will be collected from the person and the law enforcement officer or a medical professional shall collect the specimen subject to the restriction in § 50-1903(a); provided, that the person may object to a particular type of specimen collection for chemical testing on valid religious or medical grounds. If a person objects to blood collection on valid religious or medical grounds, that person shall only be required to submit breath, oral fluid or urine specimens for collection.”.

(i) Section § 50-1911 (d) is amended to read as follows:

“(d)(1) If a person under arrest refuses to submit specimens for chemical testing as provided in § 50-1910(a), and the person was involved in a collision that resulted in a fatality, except as provided in paragraph (2) of this subsection, a law enforcement officer may employ whatever means are reasonable to collect blood or oral fluid specimens from the person if the law enforcement officer has reasonable grounds to believe that the person was intoxicated or was under the influence of alcohol or of any drug or any combination thereof.

“(2) If a person required to submit to blood collection under paragraph (1) of this subsection objects on valid religious or medical grounds, that person shall not be required to submit blood specimens but the law enforcement officer may employ whatever means are reasonable to collect breath or urine or oral fluid specimens from the person if the law enforcement officer has reasonable grounds to believe that the person was intoxicated or was under the influence of alcohol or of any drug or any combination thereof.

(j) Section § 50-2206.01(18) of the District of Columbia Traffic Act, 1925 (D.C. Law 91- 910 358; D.C. Official Code § 50-2206 et seq.) is amended to read as follows:

“(18) “Specimen” means that quantity of a person’s blood, breath, oral fluid or urine necessary to conduct chemical testing to determine alcohol or drug content. A single specimen may be comprised of multiple breaths into a breath test instrument if necessary to complete a valid breath test, or a single blood draw or single urine or oral fluid sample regardless of how many times the blood or urine or oral fluid sample is tested. As used in this paragraph, “oral fluid” means all secretions from a person’s oral cavity. “.

Section 12. Freedom of Information Act exemption.

Records of the electronic seed-to-sale tracking and reporting system, that tracks retail marijuana from either seed or immature plant stage until the sale of the marijuana product to a customer at a retail marijuana store implemented and maintained by the Alcohol Beverage Regulation Administration pursuant to section 7 of this act shall not be made available as a public record under section 202 of the Freedom of Information Act of 1976, effective March 25, 923 1977 (D.C. 398 Law 1-96; D.C. Official Code § 2-532).

Section 13. Severability and Enforceability of Contract Pertaining to Marijuana

If any provision of this act, or the application thereof to any person or circumstance, is found by a court invalid, such determination shall not affect other provisions or applications of this act which can given effect without the invalid provision or application, and to that end the provisions of this act are severable. All Contracts pertaining to the production, processing, and or sale of marijuana that are otherwise legally valid shall not be void or voidable.

Section 14. Fiscal impact statement.

The Council adopts the fiscal impact statement in the committee report as the fiscal impact statement required by section 602(c)(3) of the District of Columbia Home Rule Act, approved December 24, 1973 (87 Stat. 813; D.C. Official Code § 1-206.02(c)(3)).

Section 15. Effective date.

This act shall take effect following approval by the Mayor (or in the event of veto by the Mayor, action by the Council to override the veto), a 30-day period of Congressional review as provided in section 602(c)(1) of the District of Columbia Home Rule Act, approved December 24,1973 (87 Stat. 813; D.C. Official Code § 1-206.02(c)(1)), and publication in the District of Columbia Register.

THANK YOU! – Together we’ll end up with the best law possible!

Be sure to sign up for the DCMJ email list so you’ll be notified when we discuss this legislation!